Janet Yellen, ‘Chair of the US Fed’ is the most powerful banker in the world, and she just provided you with an opportunity late last night. The US Federal Reserve (our RBI equivalent) announced its first rate increase of the Federal Funds Rate (our repo rate equivalent) in 9 years by 0.25%. So what does this mean? Let us begin from the beginning.

Reduction in Fed Funds Rate – December 2008

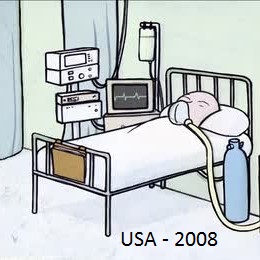

To overcome the 2008 financial crisis, the Fed drastically slashed the funds rate from 5.25% to 0.25% to encourage borrowings and thereby pump huge amounts of money into the slowing economy. An analogy can be drawn to a dying man put on ventilator. Once the man is stable, the ventilator is removed and he is allowed to breathe on his own. The reduction in rates was like putting the US economy on ventilator.

Why the Fed Rate Hike now?

The US economy has to be taken off the ventilator some time. With all the key indicators like unemployment and inflation under control, the Fed has started hiking the rates. But the Fed’s statement suggested that rates would remain historically low well into the future, saying it expects “only gradual increases.” The Fed Funds rates since 1970s is plotted below.

How does it affect India?

Fed Rate increase leads to higher rate of return on savings in form of bonds or FD in the US. Investors shall thus be lured towards investing in US rather than riskier emerging economies. The rate hike affects India in two major ways:

How does it affect me? And what are the opportunities ?

Post the hike, Japan’s Nikkei added 1.9 per cent, on top of Tuesday’s 2.6 per cent advance. Australian stocks climbed 1.6 per cent, while South Korea put on 0.8 per cent. US stocks have of course jumped. The rate hike is perceived as a mark of confidence in the slowing world economy. Indian Market has already corrected itself previously while preparing for the Fed rate hike, so today it is expected to bounce back.

Gold rates have slumped nearly 10 percent this year, partly due to uncertainty in the Fed rate hike. Now that uncertainty has been removed, gold price in India is expected to rise with increase in dollar rate in the short run. In the longer run however, when dollar gives better returns, gold rates should reduce internationally.

The Dollar jumped nearly 1 percent against a basket of major currencies last night. It is expected to test 70 rupee levels in the coming months. It is a good time to book export orders.

Questions? Suggestions? Got something to add? We would like to hear from you.

Want to book export orders now? Contact us.