The long term optimism for India’s economic prospects has been recently unsettled by the short term vagaries of stock markets and news of banking crisis. The situation has left most of us confused about the 2016 outlook.

The graph to the left represents a long term forecast while the one in the right is short term data of the past. Although the stock markets have not done well in the short term, the long term mood remains upbeat. However, there is one critical factor which might spoil the party for India: Banking Crisis.

What is the banking NPA crisis?

A loan given by the bank becomes Non Performing Asset (NPA) when it ceases to generate income for the bank usually after waiting for a period of 90 days. In simple terms, bad loans that are not being paid by borrowers (like Vijay Mallya’s Kingfisher Airlines) are NPAs. These NPAs along with restructured assets (re-negotiation of loan terms with the bank) are known as Stressed Assets (SA)

SA = NPA + RA

Over the past years, the stressed assets have increased to 11.3% of total loans provided which means out of every 100 rupees lent, 11.3 rupees might not be repaid to the bank. This is a huge amount of money – nearly 7.7 lac crore rupees.

So, what is the RBI doing?

The Reserve Bank of India has identified the problem and proactive steps have been taken to contain it. In a recent Asset Quality Review (AQR) the RBI asked banks to recognise some top defaulting accounts as non-performing ones and provide for them. “Providing” means writing off/provisioning here or in simple terms, accepting the loss of a loan. The result was that the aggregate net profit of the 39 listed banks fell 98% to Rs.307 crore in the December quarter from Rs.16,806 crore in the year earlier.

The RBI in its diktat has cleared its intent is to have clean and fully provisioned bank balance sheets by March 2017.

The previous banking subprime crisis in 2009 did not affect our banking system. What is different this time?

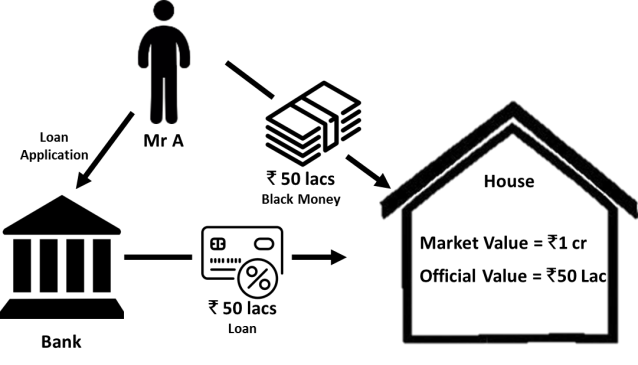

Black money. Yes, the circulation of black money in the real estate sector in India was the major reason behind aversion of the subprime crisis in India. Let us understand this by an example. Mr. A purchases who purchases a house for Rs 1 crore, paid Rs 50 lacs through bank loan (“officially”) and Rs 50 lacs in cash (“black money”) to save on stamp duty and capital gains for the seller.

Now when property prices fell in 2009 during the subprime crisis the bank loan was still comfortably within the value of the property. This is because the bank provided a loan only on the “official” value of the property of Rs 50 lacs instead of the market value of Rs 1 crore. In the US, banks offered mortgages at 100% of the value of the property, hence when the property rates dropped drastically, banks were not able to recover their dues.

Black money in today’s scenario cannot save the banking system from willful defaulters and bad loans.

How does this affect me and the Indian economy?

Banks are expected to mop up their NPAs upto March 2017. Each quarterly results may bring booking of losses and writing off bad loans. Stock markets tend to react adversely to red bottom lines. Banking stocks are hence expected to underperform.

Moreover, loans will be sanctioned after more scrutiny than before. Sanctioned loans may also be disbursed based on priority to customers with better credit. In spite of lowering of interest rates, we may see reduced credit growth since banks would lower funding to high risk projects. The GDP growth projection of 7.5% set by the finance minister in such a case might be a tough ask.

External factors such as declining exports, global slowdown, falling commodity prices could rock the ship, but internal deficiencies in banking and infrastructure can sink it. As Muhammad Ali puts it

It isn’t the mountains ahead to climb that wear you out; it’s the pebble in your shoe.

Questions? Suggestions? Got something to add? We would like to hear from you.

Want to fund your business? Contact us.

Is it right time to invest in share market?

LikeLike

That depends on the horizon you are looking at. From a long term perspective of say 10 years, it is a good time.

LikeLiked by 1 person

Good article. Waiting for more from you

LikeLike