Finance Minister Arun Jaitley in his interview to PTI in December 2015 outlined the optimism for Indian economy the government is projecting. He was quoted saying “As the year ends, I look back with a sense of great satisfaction,”. However, the same optimism was not shared by many industry stalwarts and most households. So why is it that while the Finance Minister is satisfied with his economic performance, industry and public are still waiting for the “Acche Din”?

Although there are many factors, let us analysis it from the point of view of WPI and CPI.

What is WPI and CPI?

Wholesale Price Index (WPI) measures the changes over time general levels of price of goods and services as far as possible all transactions at first point of bulk sale in the domestic market.

Consumer Price Indices (CPI) on the other hand measure changes over time in general level of prices of goods and services that households acquire for the purpose of consumption.

While the two indices vary in terms of variation in base years, basket of items and weights allocated to the individual items, these indices are used as indicators of price movement in wholesale and consumer prices. Just as BSE Sensex is an index of 30 companies which gives a general indication of the movement of stock markets, WPI and CPI are used as inflation indicators. WPI is also known as headline inflation while CPI as retail inflation.

So, what has been happening to the WPI and CPI?

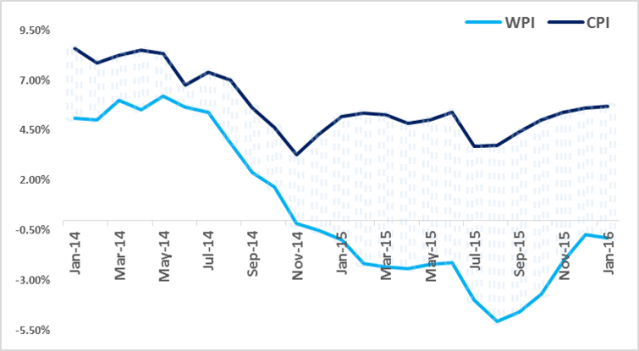

Since May 2014, both WPI and CPI inflation rates have been moving downwards. In Nov’14, the WPI contracted to a negative 0.17% . What it means is wholesale prices of commodities in Nov’14 were cheaper by 0.17% as compared to Nov’13 (year on year comparison).

Although the movement of WPI and CPI is more or less synchronous in terms of direction, the gap between the two indices has widened in 2015. Simply put, even though wholesale prices had dropped, the retails prices did not reduce but inflated at an approximate rate of 5%.

Ideally in a really competitive integrated market, price changes at the upstream level, i.e., the raw material, intermediate goods and capital goods (WPI), get reflected in the final products and eventually in the CPI. However, our market is not integrated and the changes are not getting reflected in CPI. The benefit of lower production costs is getting lost in the value chain before it reaches the end consumer.

What are the effects to such a movement of WPI and CPI?

The WPI inflation has been declining for 15 straight months. This can be attributed to the significant fall in the global commodity prices, leading to a decline in the prices of raw materials. It also reflects the domestic conditions and dampened demand. So for manufacturers, while manufacturing is cheaper, selling is tougher.

The CPI inflation on the other hand has not reduced. While consumers have not enjoyed the benefit of lower costs, the traders and stockists on the other hand have enjoyed higher margins.

Are there specific industry examples?

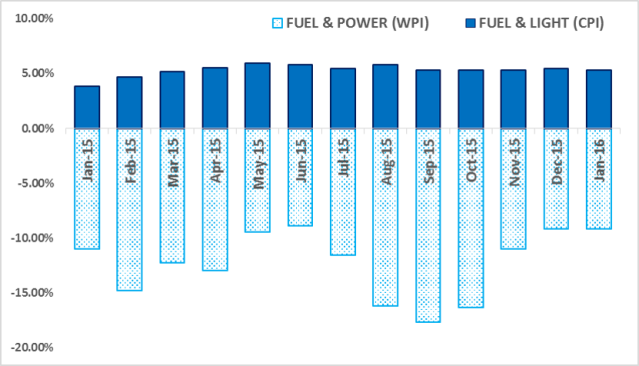

The falling crude prices and the increasing government excise duty on it to stabilize prices is well know. This is reflected in the WPI and CPI chart. Though 2015, the Fuel and Power WPI inflation was negative at around -12%, however the Fuel & Light CPI remained positive at around 5%. The government has benefited from the global oil slump rather than passing the benefit to the consumer.

Similar examples over the past year can be seen in Clothing (Textile) industry. The traders and retailers have managed to increase margins without passing the benefit to customers. The food industry indices have behaved rather erratically bringing windfall gains for hoarders and stockists during the April to November 2015 period.

How is this affecting India and me?

With manufacturing WPI dipping into the negative, job creation will be impacted. Retail inflation being higher, consumers will have to shell out more. The RBI is unlikely to prescribe another rate cut unless the CPI inflation is contained. Unless there is an overturn in the current trends, the retail prices shall continue to increase while the industrial demand remaining damp.

The only bright spot from the current scenario comes for infrastructure development in new projects. The commodity prices are at it lowest in 10 years and demand is expected to pick over a horizon of 2 years when the project shall become operational.

Do look at the inflation numbers released on 15th of each month. Questions? Suggestions? Got something to add? We would like to hear from you.

Want a business aspect to be researched before deciding on a key decision? Contact us.

Excellent article by M/s Bhansalis, making the concept easy for understanding.

Keep us sending such articles.

LikeLike

Excellent Article by CA Sarthak Bhansali, posting on current happenings in a very precise and explanatory manner with note worthy short analysis..

Please keep sending Such informative articles

LikeLike